Loan

Amortization Schedule

Excel Template

What's Inside the Loan Amortization Schedule Template?

Details | 7 Sheets

Supported Versions (All Features) | Excel 2013, 2016, 2019, Office 365 (Mac)

Supported Versions (Significant Features) | Excel 2010, 2013, 2016, 2019, Office 365 (Mac)

Category | Accounting , Personal Finance

Tags | Monthly Payment Calculator

Why Professionals Choose Simple Sheets

It's simple. Access to the largest library of premium Excel Templates, plus world-class training.

100+ Professional Excel Templates

Optimized for use with Excel. Solve Excel problems in minutes, not hours.

World-Class Excel University

With our university, you'll learn how we make templates & how to make your own.

How-To Videos

Each template comes with a guide to use it along with how-to videos that show how it works.

Inside Our Loan Amortization Schedule Excel Template

Albert Einstein once said, “Compound interest is the 8th wonder of the world… he who understands it earns it… he who doesn’t… pays it.” Basically, you can’t afford to not know how debt plays into your financial future.

In some cases it will be inevitable. Paying cash for a house, car or 4-year degree isn’t exactly pocket change you’d find stuffed in-between your couch cushions.

That’s where our Loan Amortization Schedule Excel Template comes in handy. It calculates interest payments, principal, beginning and ending balances as well as extra payments based on the specific details of your loan for up to five loans.

This template is equally suited for businesses and personal use.

Popular ways to use the template are for auto loans, mortgage, student debt or a business loan. This is a wildly helpful tool to use when comparing loan terms or negotiating with a car dealer who wants to put you in a new Buick for 84 months but “only” a $200 payment (just say no).

Before we dive into this spreadsheet, you may also want to check out our Net Worth Calculator or Personal Budget Analysis Templates to take control of your finances.

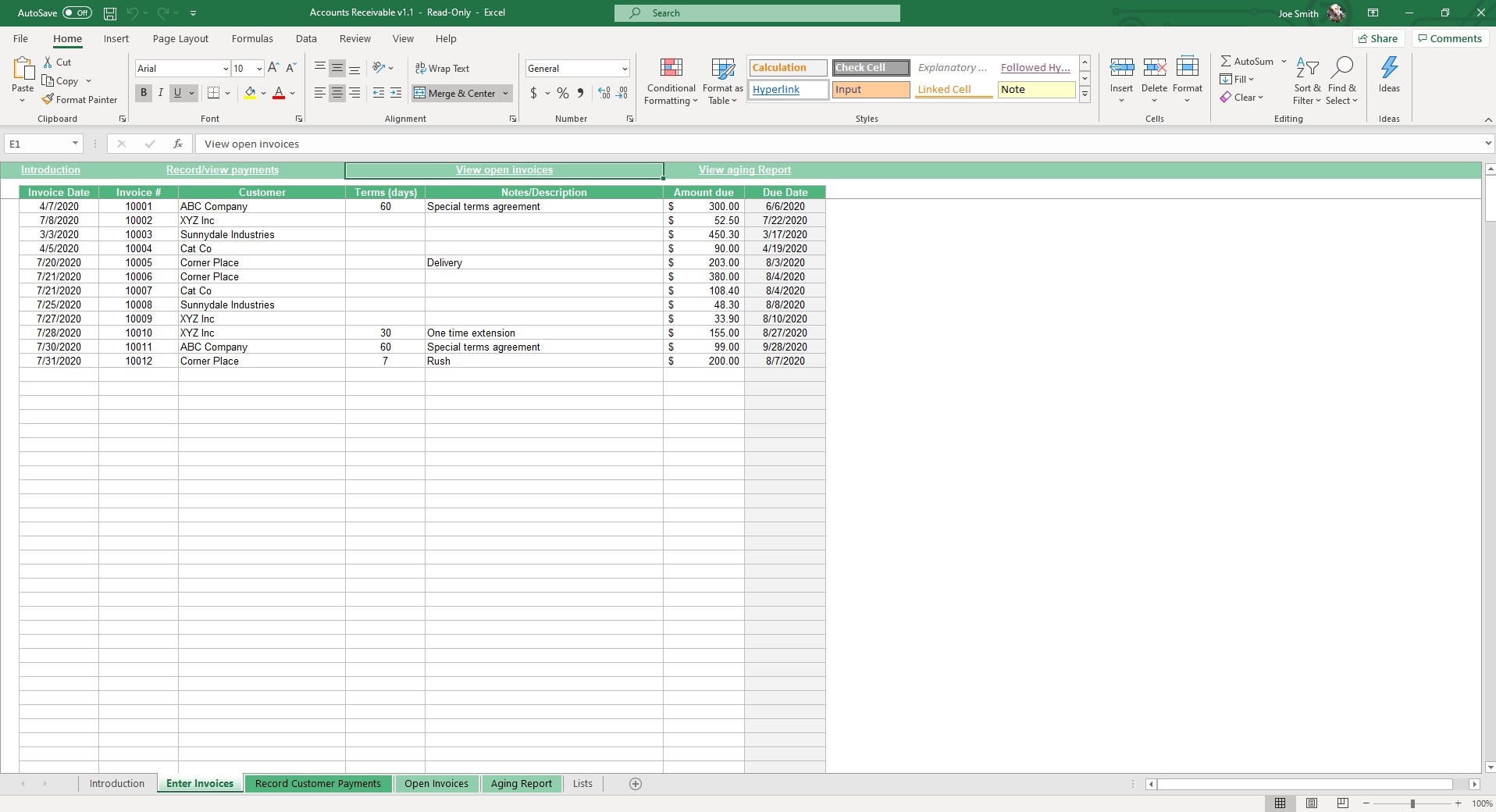

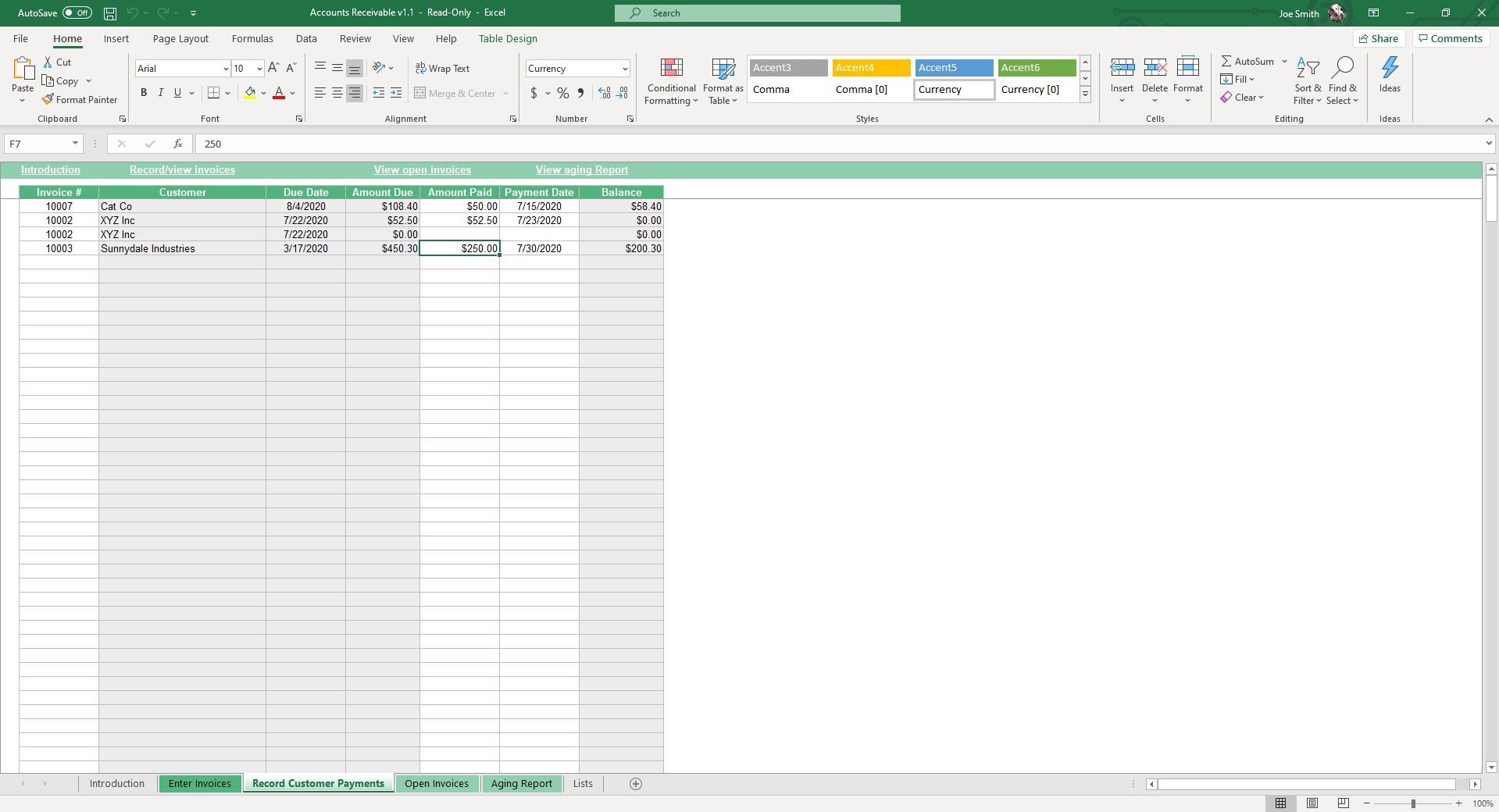

In the Loan Schedule sheet, input data related to your loan like Loan Amount, Annual Interest Rate, Loan Period in Years, Number of Payments Per Year, Start Date of Loan and Optional Extra Payments.

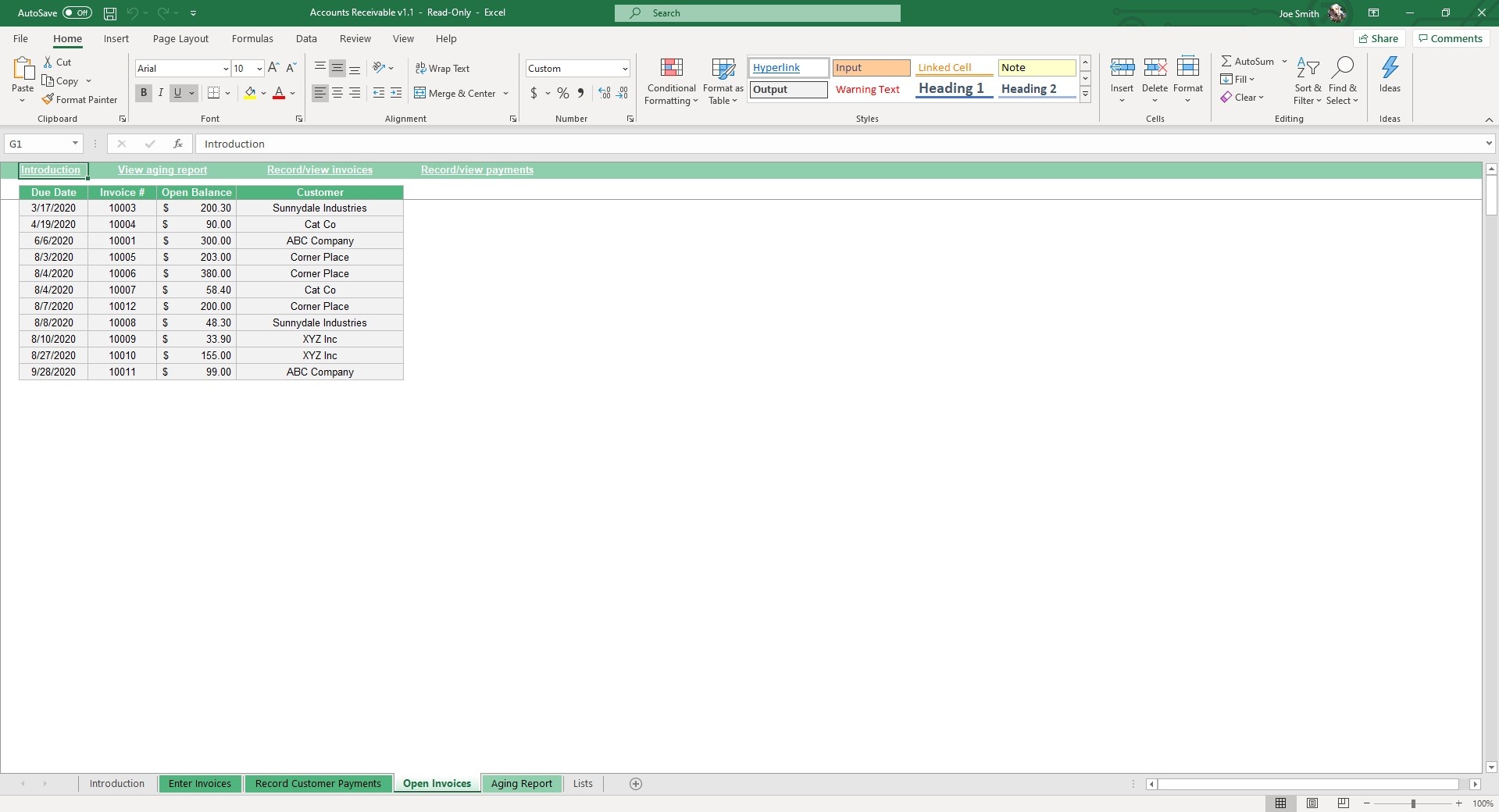

The template will auto populate the Loan Summary and every payment, showing the balance, interest and cumulative interest.

Your information from the Loan Schedule sheet will automatically sync to the Dashboard sheet. The Dashboard allows you to visualize your loan data with graphs and charts that display your payment breakdowns by month and principal payments vs. interest payments.

As you add other Loan Schedules to the template, you will get a clear picture of what your financial debt looks like and can plan accordingly.