Bond Stress Test Analysis

Excel Template

What's Inside the

Bond Stress Test Template?

Details | 2 Sheets

Supported Versions (All Features) | Excel 2019, Office 365 (Mac),

Supported Versions (Significant Features) | Excel 2016, 2019, Office 365 (Mac),

Category | Finance

Tags | Loan, Amortization, Interest

Why Professionals Choose Simple Sheets

It's simple. Access to the largest library of premium Excel Templates, plus world-class training.

100+ Professional Excel Templates

Optimized for use with Excel. Solve Excel problems in minutes, not hours.

World-Class Excel University

With our university, you'll learn how we make templates & how to make your own.

How-To Videos

Each template comes with a guide to use it along with how-to videos that show how it works.

Inside Our Bond Stress Test Analysis Excel Template

By definition, bonds are debt that are issued by companies or even governments that are securitized so you can have them as tradeable assets. These are more popular as long-term investments because of their relatively low risk, predictable income stream, and if held to maturity, you can get the principal back preserving your capital. But for everyone else, bonds are the literal and figurative bond that holds together corporations and governments. For a lot of companies (like yours) and municipalities, funding projects would simply not be possible without issuing bonds. With our Bond Stress Test Analysis Excel Template, you can instantly compute and check bond performance so you can choose the best one for your portfolio! Before we begin talking about this awesome template, be sure to check out our other finance templates such as the Stock and Crypto Portfolio Tracker, Profitability Analysis, and Loan Amortization Schedule templates to empower you to stay on top of your loans and investments with minimal effort!

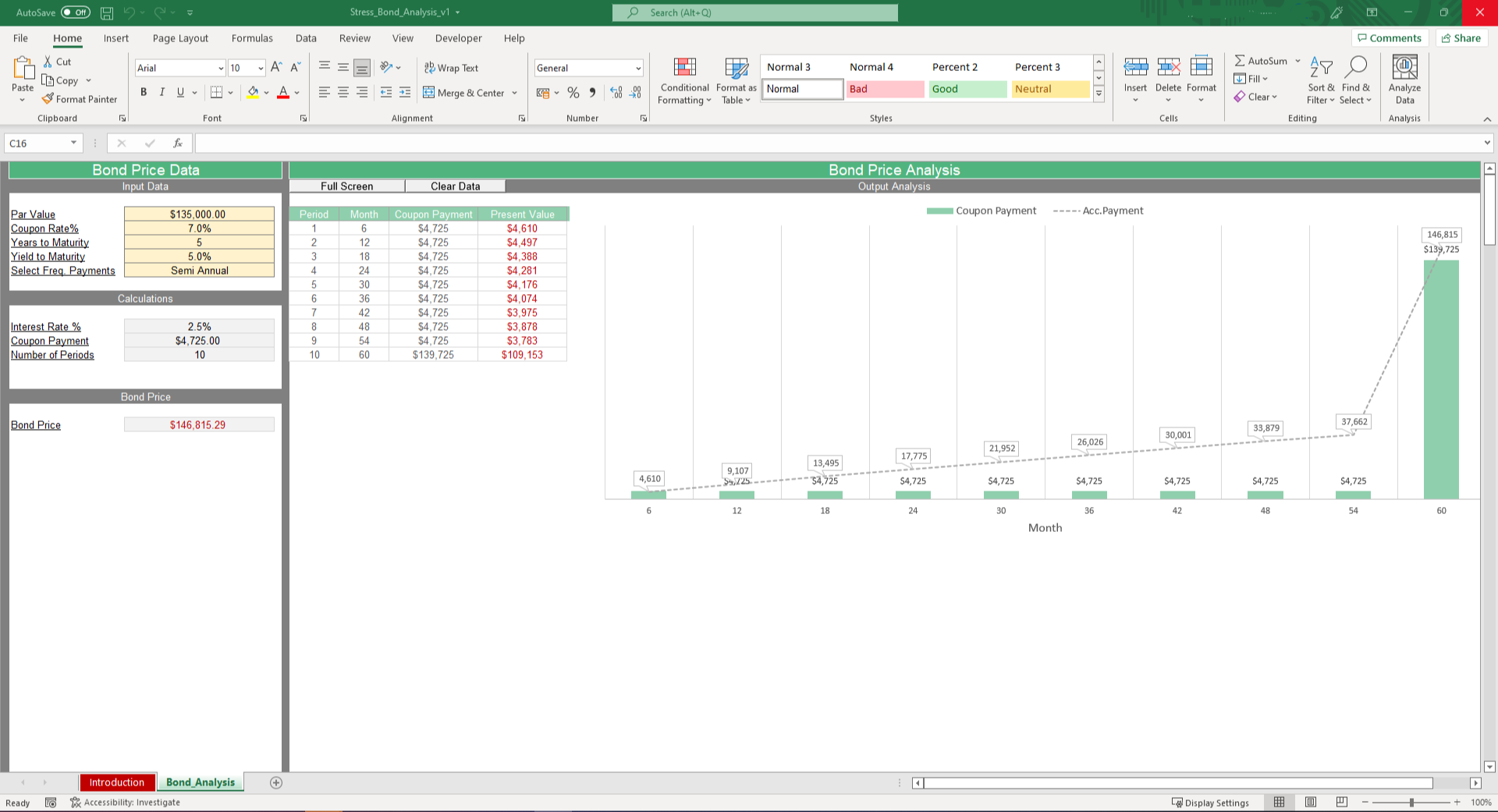

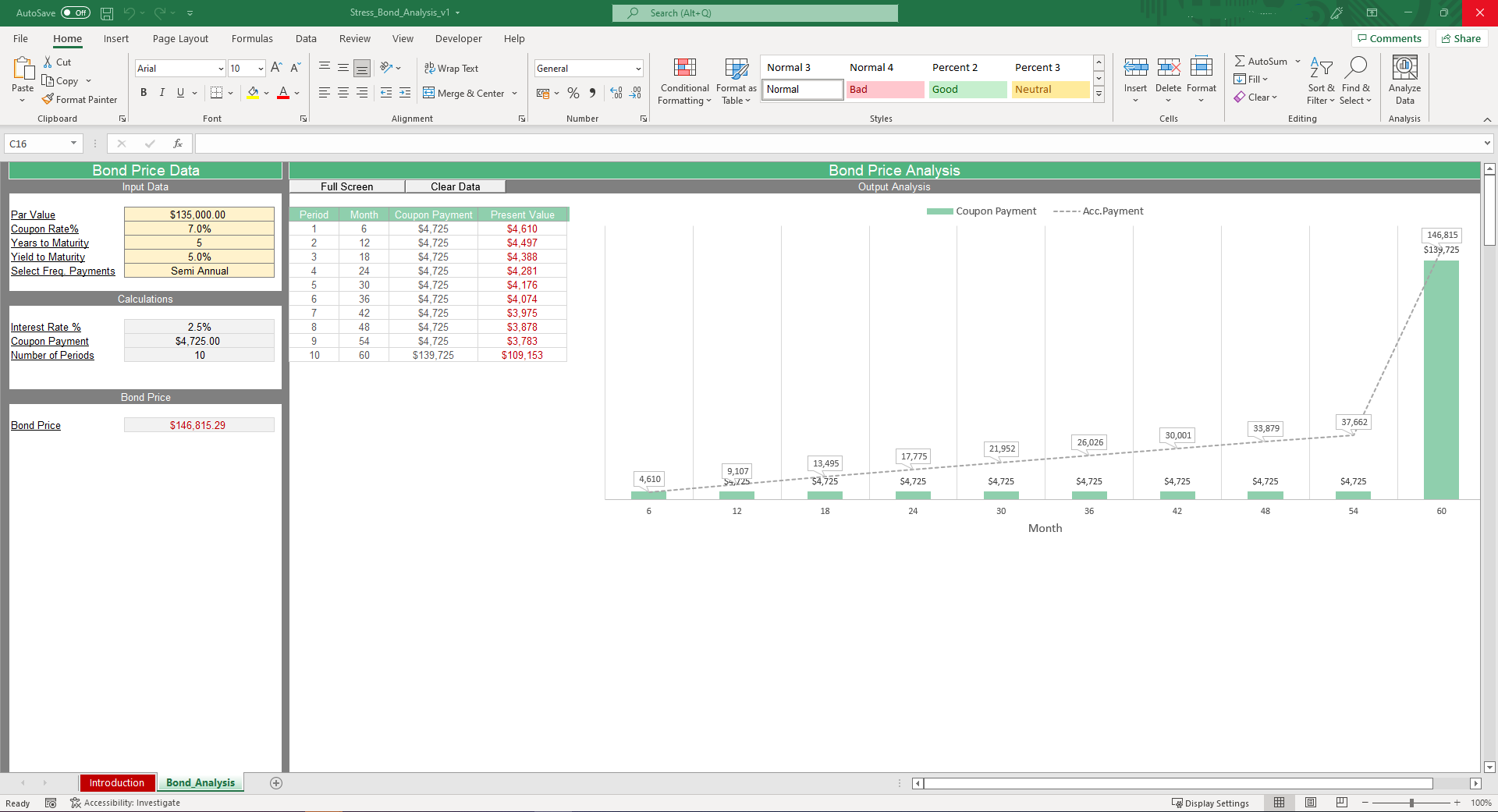

Ken Fisher said it perfectly that “time in the market beats timing the market.” To help you put more of your time in the market, this template gets down to business with only one sheet to work on. In the Bond Analysis Sheet, there’s only five cells you need to edit. Enter the bond’s par value, coupon rate, years to maturity, yield to maturity, and the frequency of payment. It’s that easy! The calculations portion automatically updates down below which gives you the interest rate, coupon payments, and further beneath that, you can see the bond’s price after maturity.

If we’re being totally honest, we could stop there. You can already make a grounded decision to take this bond or look for a better one. Just like a bad informercial, wait! There’s more! On the righthand portion we have our output analysis so we can further dissect what our potential income stream might look like for a particular bond. The table on the left automatically updates depending on your inputs earlier and shows you a coupon payment schedule as well as the all-important projected present value according to the time value of money. Over to the right of that, we have a graph that gives you a visual representation of what your cashflow schedule looks like in comparison to its present value. Being your own fund manager has never been easier that with Simple Sheets!