Credit Card Payoff Calculator

Excel Template

What's Inside the

Credit Card Payoff Calculator Template?

Details | 2 Sheets

Supported Versions (All Features) | Excel 2019, Office 365 (Mac)

Supported Versions (Significant Features) | Excel 2016, 2019, Office 365 (Mac)

Category | Finance

Tags | Credit Card, Payment, Interest

Why Professionals Choose Simple Sheets

It's simple. Access to the largest library of premium Excel Templates, plus world-class training.

100+ Professional Excel Templates

Optimized for use with Excel. Solve Excel problems in minutes, not hours.

World-Class Excel University

With our university, you'll learn how we make templates & how to make your own.

How-To Videos

Each template comes with a guide to use it along with how-to videos that show how it works.

Inside Our Credit Card Payoff Calculator Excel Template

Struggling to keep up with credit card payments? High interest and unclear timelines can make it feel impossible to get ahead. Fortunately, our Credit Card Payoff Calculator Excel template helps you take control.

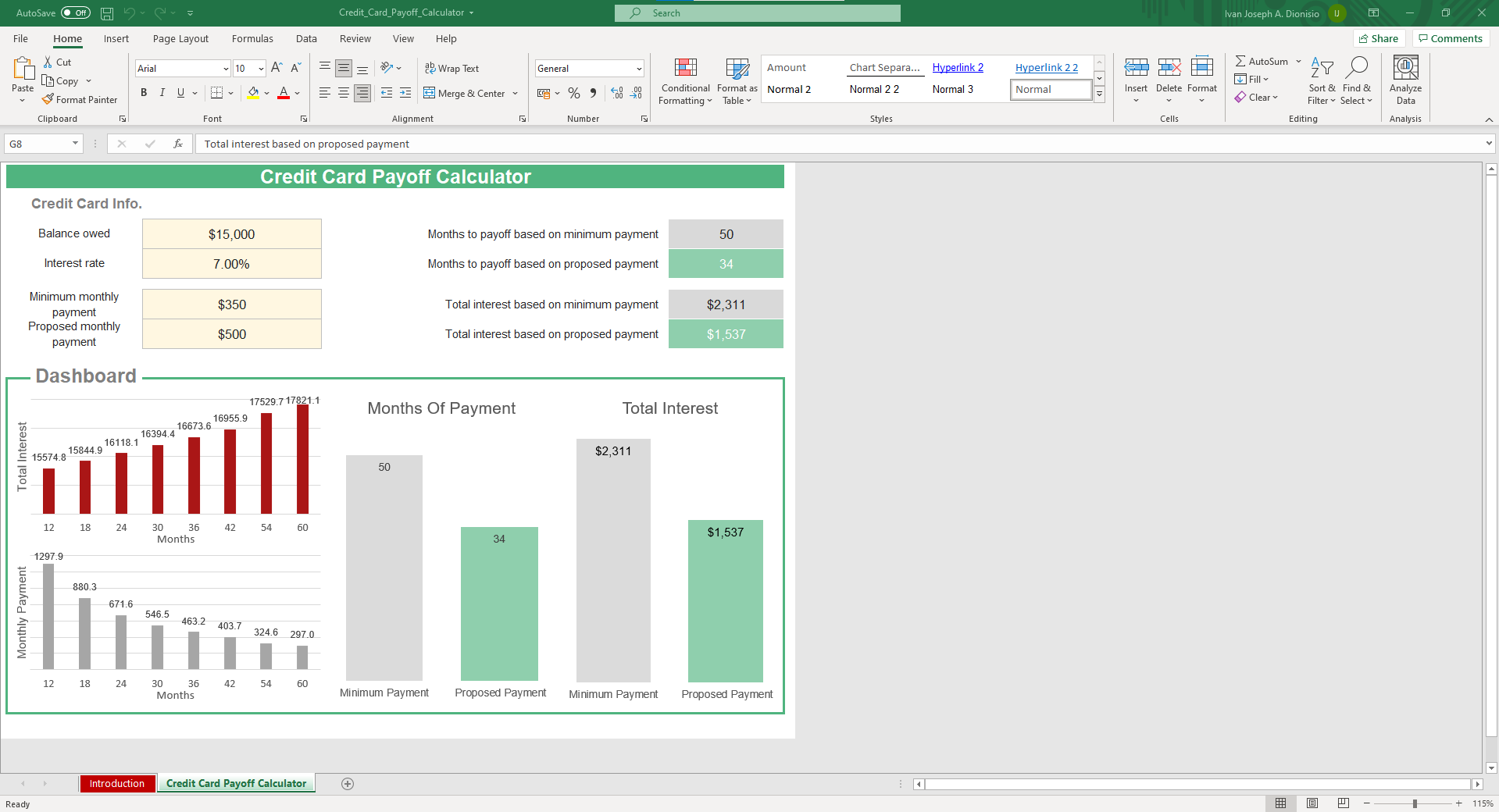

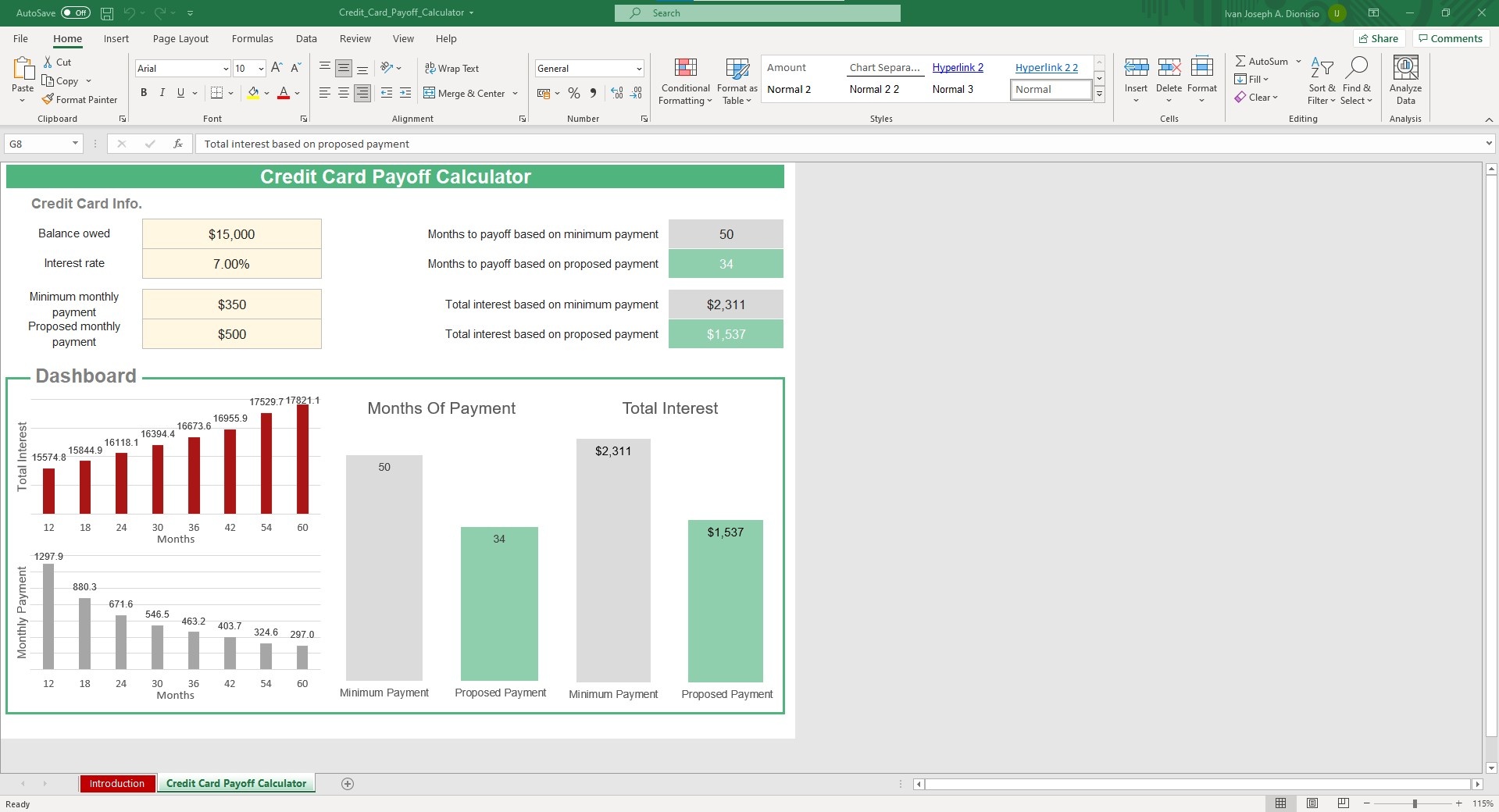

All you need to do is enter your balance, interest rate, and payments. The Excel credit card payoff calculator template instantly shows how long the payoff will take and how much interest you’ll pay. With clear charts comparing minimum vs. proposed payments, you’ll see exactly how to save money and pay off debt faster.

Why Use Our Credit Card Payoff Calculator Excel Template?

It is more challenging to pay off your credit card debts when the interest keeps piling up. Our Excel credit card payoff calculator makes it easy to see the full picture and create a clear plan.

- Remove the guesswork: Instantly calculate how long the payoff will take with your minimum and proposed payments.

- See your savings: Compare total interest for different payment amounts.

- Stay motivated: Use the built-in dashboard and charts to track your progress visually.

Works your way: Use it in multiple Excel versions as a credit card repayment tracker.

Credit Card Payoff Calculator Features

Our credit card payoff calculator Excel template is built to make debt tracking fast, simple, and accurate. Check out its features below:

- Automatic payoff timeline: Instantly see how many months it will take to pay off your balance with your minimum and proposed payments.

- Total interest calculation: Compare interest costs for different payment amounts.

- Visual dashboard: Built-in charts show monthly payments, interest over time, and minimum vs. proposed payoff.

- Easy customization: Update your balance, interest rate, and payment amounts anytime.

How to Use the Credit Card Payoff Calculator Template

You don’t need to be a spreadsheet expert to use our Credit Card Payoff Calculator Excel template. Follow this step-by-step guide to quickly build a repayment plan and stay on track until you’re debt-free.

- Enter your credit card details: Fill in your total balance, interest rate, minimum monthly payment, and proposed monthly payment.

- View your payoff timeline: See how many months it will take to pay off your balance for both payment options.

- Check interest costs: Compare the total interest paid with your minimum vs. proposed payments.

- Review the dashboard: Use the charts to track monthly payments, interest over time, and payoff progress.

- Update anytime: Adjust your figures as your balance, interest rate, or payments change.

Who Is This Template for?

Our credit card payoff calculator Excel template is perfect for anyone who wants a simple way to track and plan debt repayment.

It’s ideal for:

- Individuals who want to see exactly when they’ll be debt-free.

- Households managing multiple credit card balances.

- Financial coaches creating repayment plans for clients.

- Anyone looking for an easy credit card repayment tracker in Excel.

Download the Credit Card Payoff Calculator Template

Start taking control of your credit card debt today with our credit card payoff calculator Excel template. It is compatible with Excel 2016, 2019, and Office 365.

Click below to get your Excel debt payoff calculator and begin your journey to becoming debt-free.

About Simple Sheets

At Simple Sheets, we create easy-to-use Excel templates that save you time and make complex tasks simple. Our tools are designed for professionals, households, and businesses seeking clear, automated solutions. If you liked the Credit Card Payoff Calculator Excel template, check out our Personal Budget Breakdown, Business Valuation, and Loan Amortization templates.

FAQ

Which Excel versions are supported?

We recommend Excel 2016 or later for the best experience and full functionality.

Can I customize the template?

You can update your balance, interest rate, and payment amounts anytime to fit your repayment plan.

Does it calculate interest automatically?

The template automatically calculates total interest for both your minimum and proposed payments.

Will the charts update as I change my numbers?

The dashboard charts update instantly when you change your credit card details.