Payroll

Excel and Google Sheets Template

What's Inside the Payroll Template?

Details | 5 Sheets

Supported Versions | Excel 2010, 2013, 2016, 2019, Office 365 (Mac), Google Sheets

Category | Accounting, Small Business

Tags | Hours, Taxes, Calculator, Biweekly, Schedule, Ledger

Why Professionals Choose Simple Sheets

It's simple. Access to the largest library of premium Excel Templates, plus world-class training.

100+ Professional Excel Templates

Optimized for use with Excel. Solve Excel problems in minutes, not hours.

World-Class Excel University

With our university, you'll learn how we make templates & how to make your own.

How-To Videos

Each template comes with a guide to use it along with how-to videos that show how it works.

Inside Our Payroll Excel and Google Sheet Template

No business owner starts their venture excited about running administrative tasks. Still, your business won’t last very long if you aren’t on top of things like taxes and payroll. Our Payroll Excel Template is designed to organize, structure and keep records of your payroll.

If you find this template useful, you’ll also want to check out our other small business tools like Employee Scheduling, Timesheet and Expense Report templates. Each is designed to streamline and organize your key business processes that otherwise can be fragmented across expensive software and programs.

Let’s dive into how to use this spreadsheet.

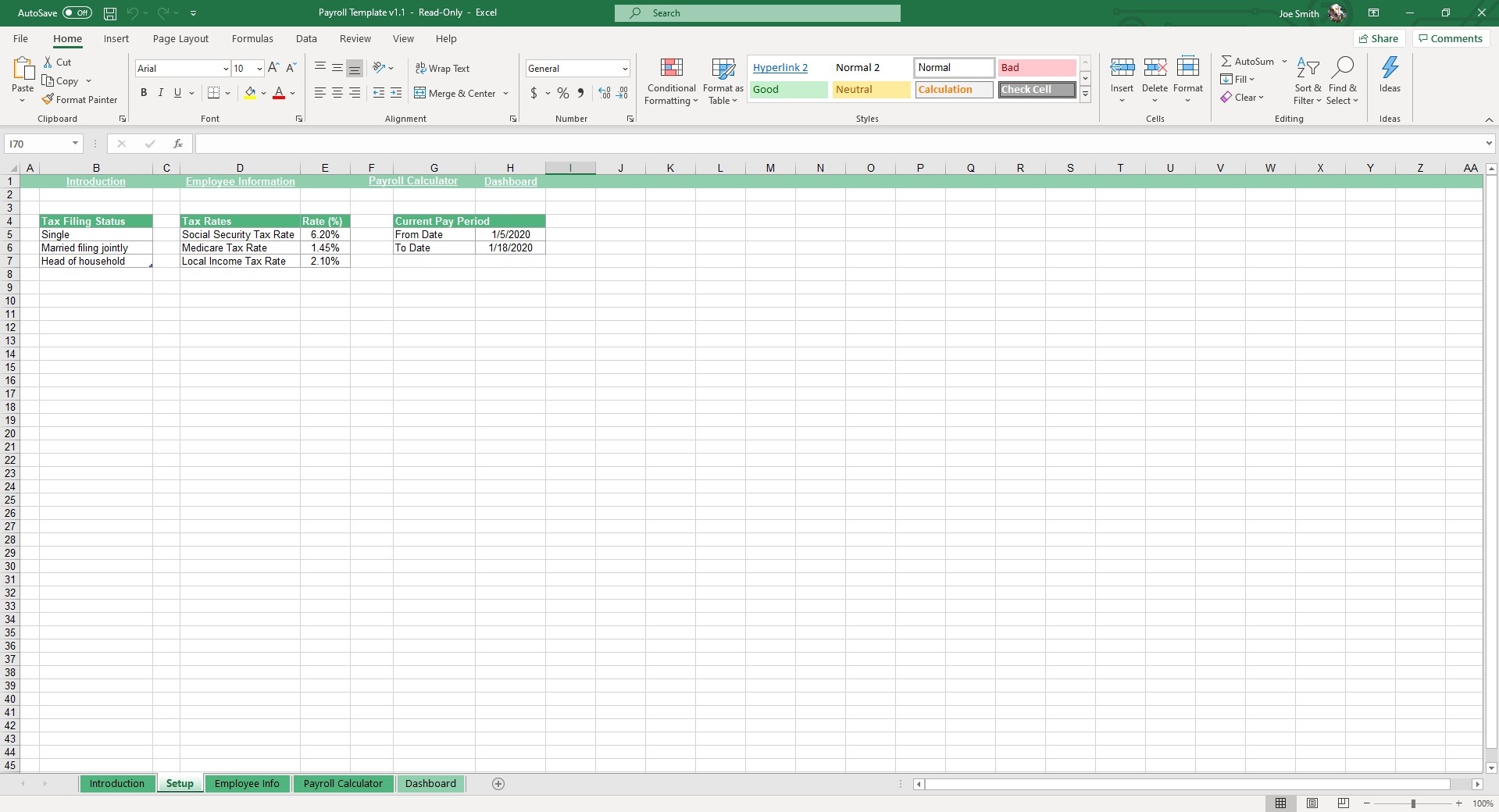

Start off in the Setup sheet where it has three columns for Tax Filing Status, Tax Rates and Current Pay Period. Adjust these as needed. If the Local Income Tax Rate changes, you can easily adjust it to fit the change.

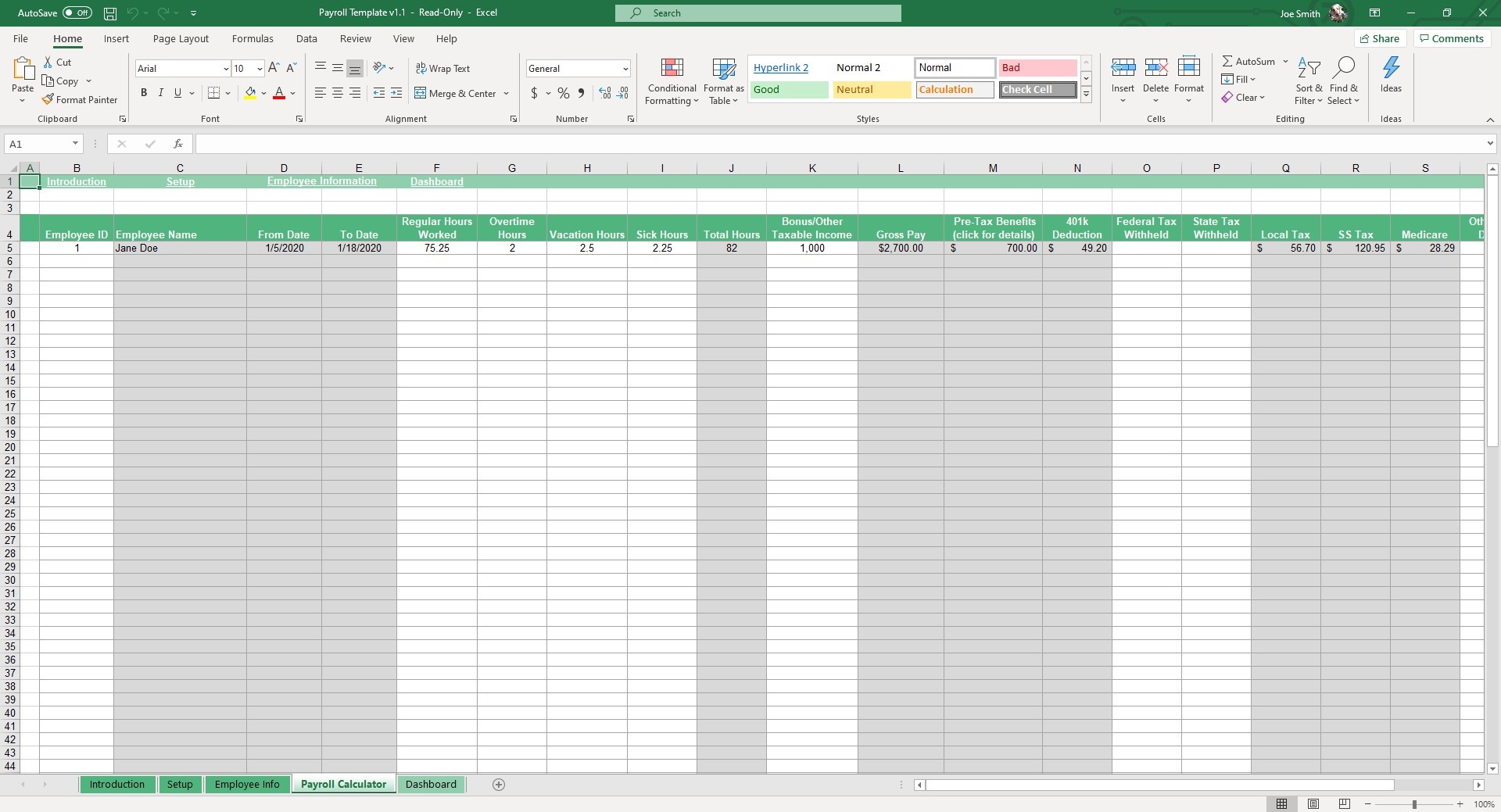

Move to the Employee Info sheet and enter employees on your payroll. Fill in the other relevant fields with white columns. These include Employee ID, Name, Hourly Wage, Overtime Wage, Tax Status, Federal Allowance (Form W-4), Other Tax %, 401K Deduction, Health Insurance Deduction, Vision Insurance Deduction, Dental Insurance Deduction, Other Pre-Tax Deduction 1 & 2 and Post-Tax Deduction 1 & 2. Grey columns are protected in this sheet as they contain formulas that will automatically calculate based on your inputs.

Hop over to the Payroll Calculator sheet. Select an Employee ID from the drop-down menu and enter their Regular Hours Worked, Overtime Hours, Vacation Hours, Sick Hours, Bonus/Other Taxable Income, Federal Tax Withheld, State Tax Withheld, and Other Post-Tax Deductions. As with the prior sheet, the grey columns will calculate automatically. This includes the employee's Gross Pay and Net Pay for the period. Repeat the process for other employees by using the next row down.

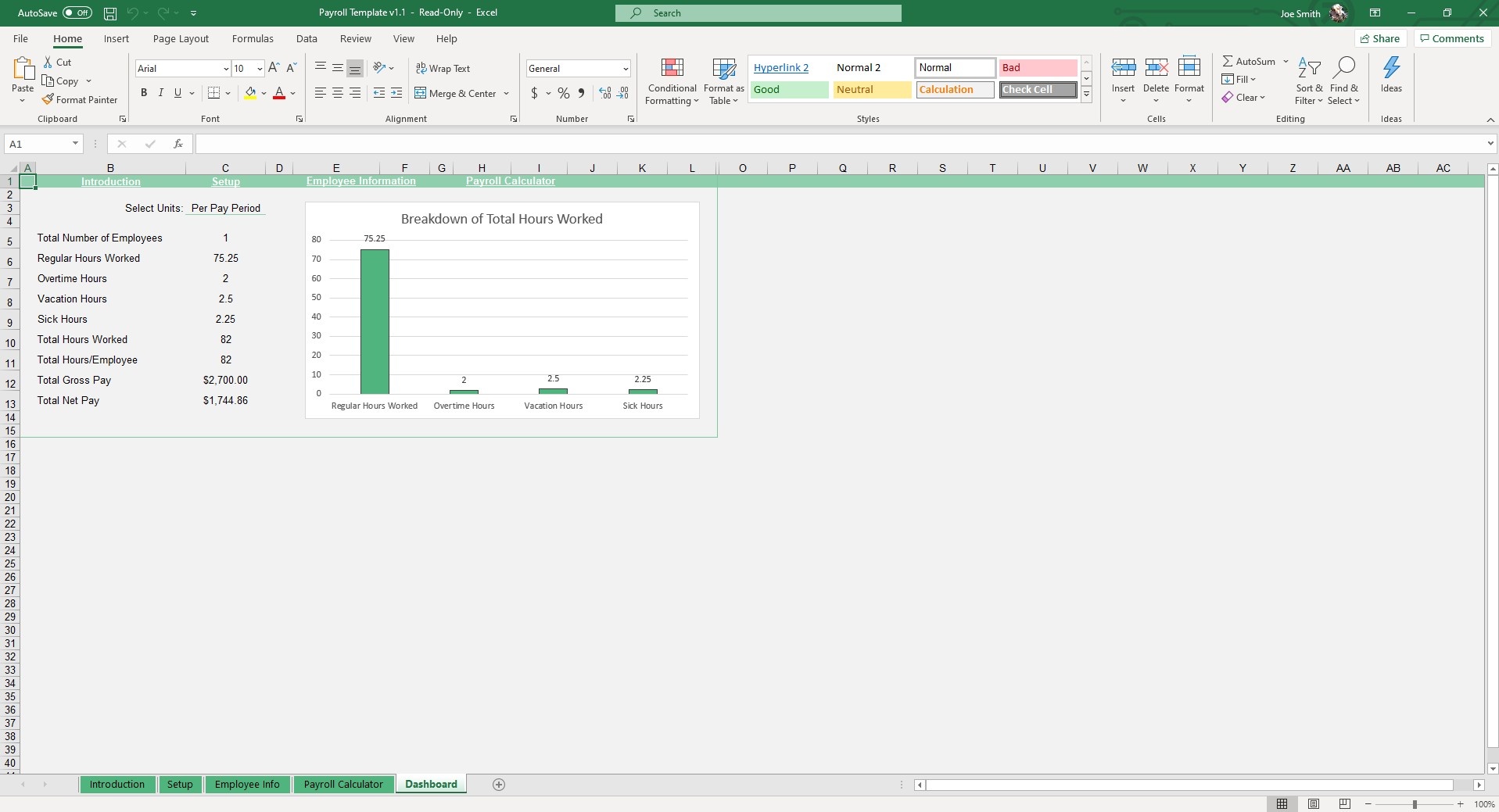

In the Dashboard sheet, you can view your payroll by Period, Week or Day. The aggregate of your company’s payroll will calculate and be displayed on a bar chart on the right hand side of the sheet so you can view Regular Hours Worked as it compares to Overtime Hours, Vacations Hours and Sick Hours.

While running payroll may never be the most fun activity, it doesn’t have to be a hassle with this customizable and easy to use template.

If that wasn't enough reason to get this template, did you know this template is compatible with Google Sheets? Collaborate with your co-workers in real time and enjoy the cloud auto-save feature of Sheets when you use this template!

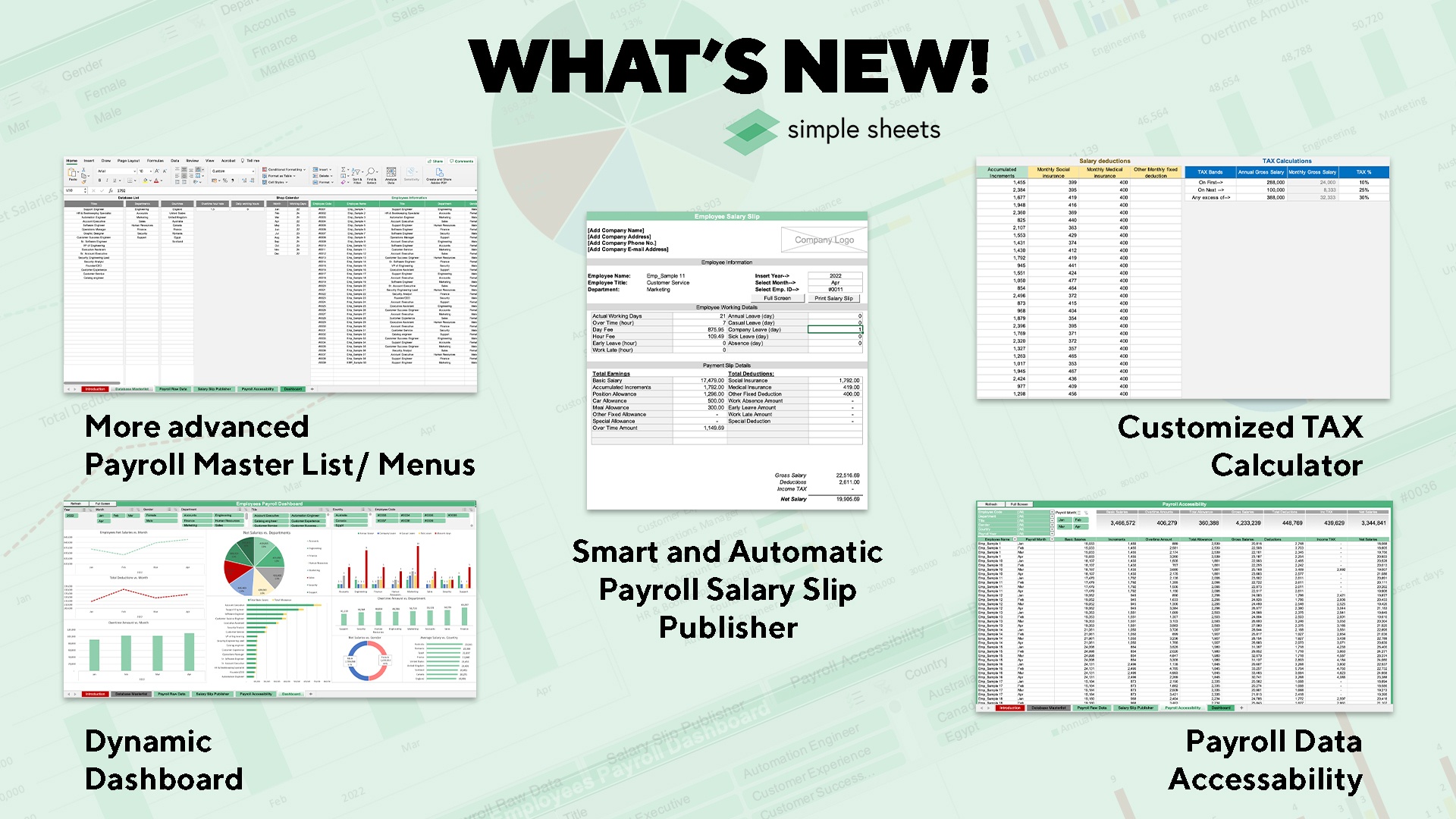

Template Updates!

We update our templates regularly so you don't have to!